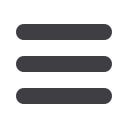

Consolidated income statement

CHF million

Notes

2015

2014

Net sales

(4)

2 085.9 100.0% 1 954.7 100.0%

Material expenses

–998.1 47.8% –964.5 49.3%

Employee expenses

(5)

–545.2 26.1% –499.8 25.6%

Other expenses

(6)

–366.6 17.6% –305.3 15.6%

Other income

(7)

15.5

0.7% 16.5

0.8%

Earnings before interest, taxes, depreciation

and amortization (EBITDA)

191.5

9.2% 201.6 10.3%

Depreciation and amortization

(8)

–65.1

3.1% –66.5

3.4%

Earnings before interest and taxes (EBIT)

126.5

6.1% 135.1

6.9%

Financial income

(9)

0.9

1.0

Financial expenses

(10)

–20.2

–16.4

Share of profit of associated companies

(15)

1.9

0.4

Profit before taxes

109.2

5.2% 120.1

6.1%

Income taxes

(11)

–40.5

–17.3

Net profit

68.7

3.3% 102.8

5.3%

Attributable

to shareholders of Autoneum Holding Ltd

42.2

78.9

to non-controlling interests

26.5

23.9

Basic earnings per share in CHF

(12)

9.12

17.03

Diluted earnings per share in CHF

(12)

9.10

16.97

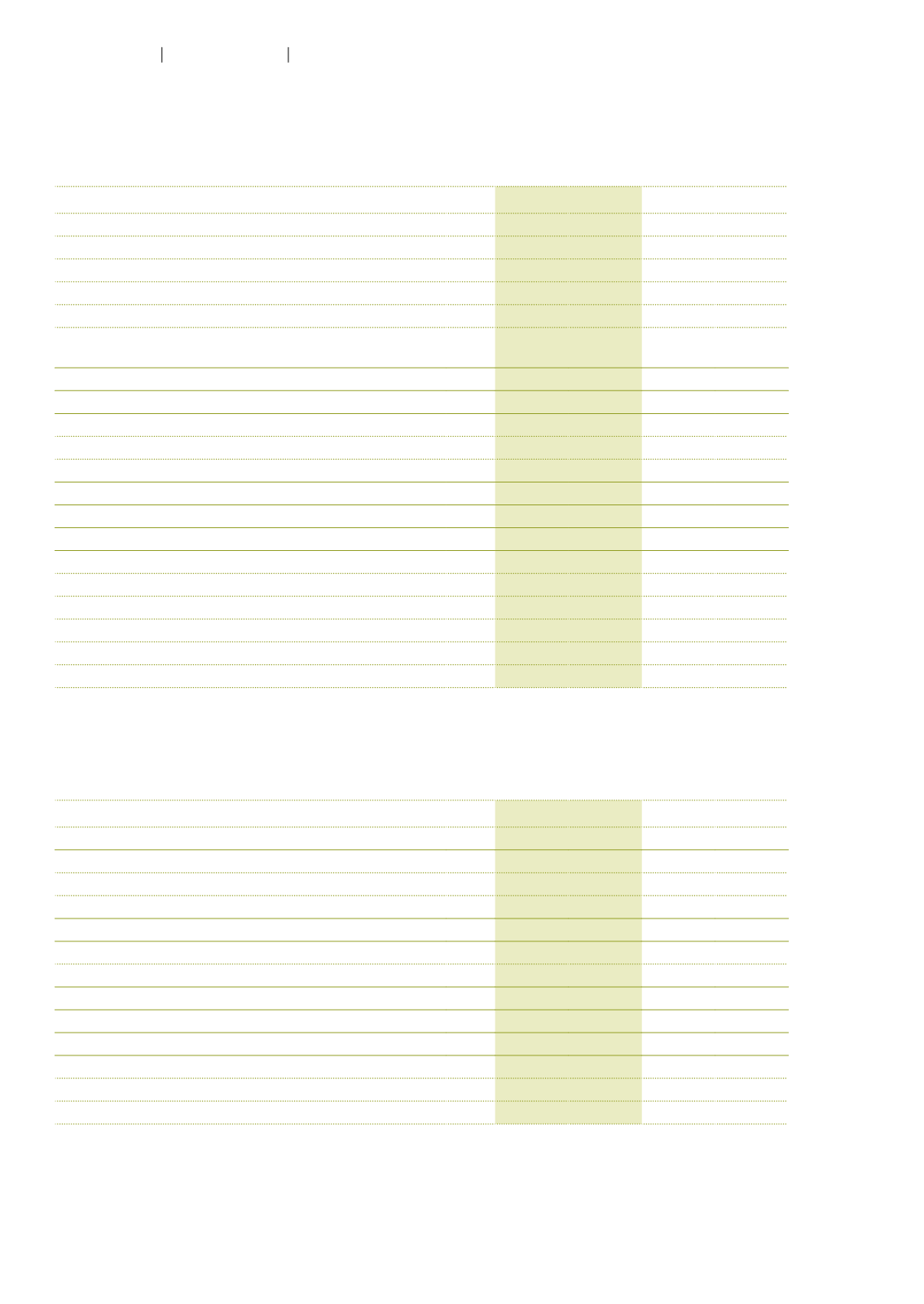

Consolidated statement of comprehensive income

CHF million

2015

2014

Net profit

68.7

102.8

Currency translation adjustment

–30.6

18.6

Changes in fair value of fin. instruments available for sale

5.2

2.8

Income taxes

-

-

Total items that will be reclassified to income statement

–25.4

21.4

Remeasurement of defined benefit pension plans

–3.5

–18.8

Income taxes

0.7

5.3

Total items that will not be reclassified to income statement

–2.8

–13.5

Other comprehensive income

–28.3

8.0

Total comprehensive income

40.4

110.8

Attributable

to shareholders of Autoneum Holding Ltd

16.0

79.5

to non-controlling interests

24.4

31.4

The accompanying notes on pages 66–102 are part of the consolidated financial statements.

62

Autoneum

Financial Report 2015

Consolidated financial statements