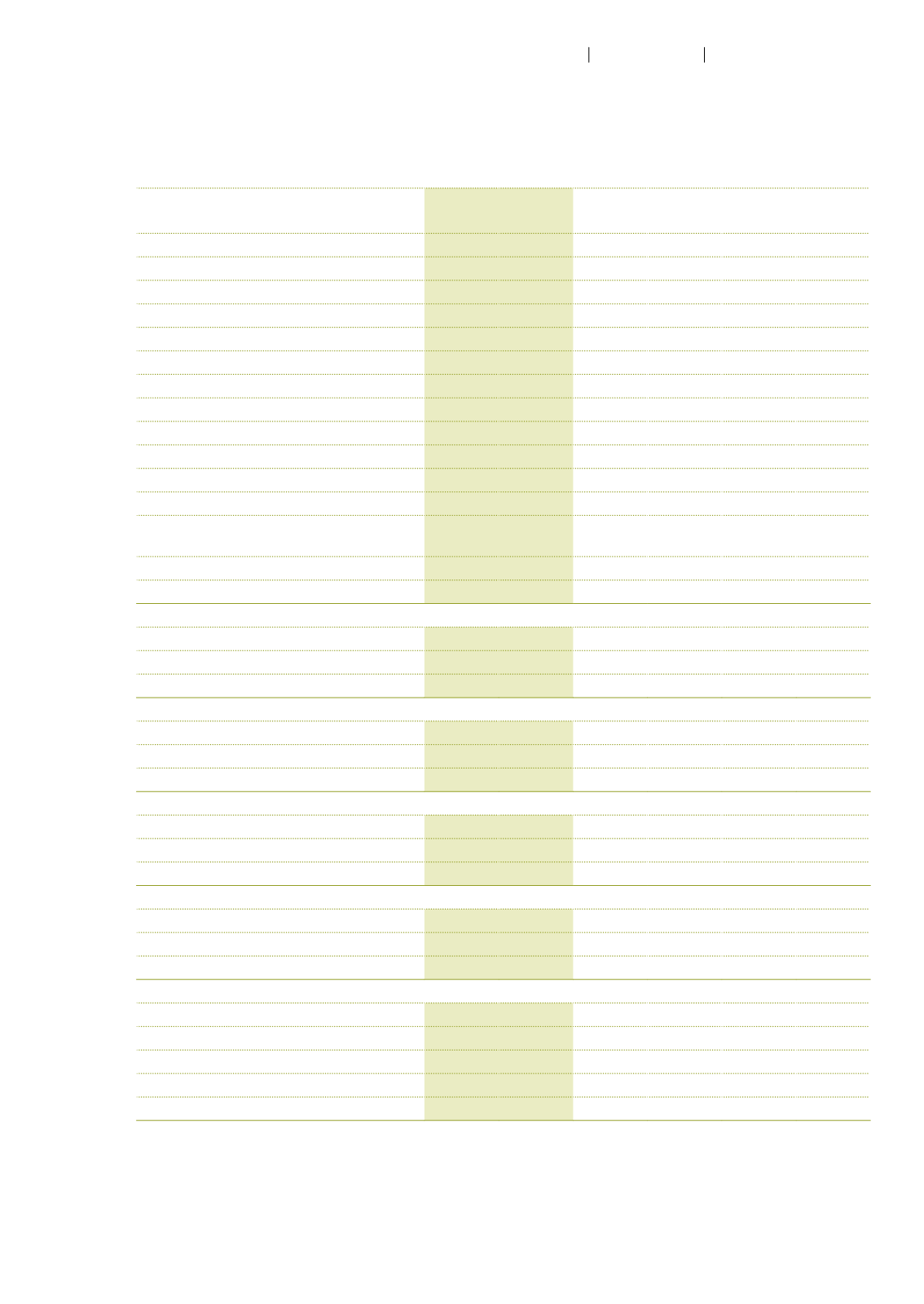

5

Autoneum Annual Report 2015

Letter to shareholders

CHF million

2015

2014

Change

Organic

growth

1

Autoneum Group

Net sales

2 085.9 100.0% 1 954.7 100.0% 6.7% 10.6%

EBITDA

191.5 9.2% 201.6 10.3% –5.0%

EBITDA adjusted

2

223.0 10.7% 201.6 10.3% 10.6%

EBIT

126.5 6.1% 135.1 6.9% –6.4%

EBIT adjusted

2

158.0 7.6% 135.1 6.9% 16.9%

Net profit

68.7 3.3% 102.8 5.3% –33.2%

Net profit adjusted

2

100.2 4.8% 102.8 5.3% –2.5%

Return on net assets in % (RONA)

3

12.7%

20.3%

Return on net assets in % (RONA) adjusted

2,3

17.7%

20.3%

Operating cash flow

111.7

138.2

Operating cash flow adjusted

2

143.2

138.2

Investments in tangible

and intangible assets

120.7 5.8% 101.9 5.2%

Net debt at December 31

105.4

53.9

Employees at December 31

4

11 423

10 681

6.9%

BG Europe

Net sales

833.2 100.0% 803.3 100.0% 3.7% 13.1%

EBIT

44.7 5.4% 31.7 3.9%

BG North America

Net sales

977.9 100.0% 882.7 100.0% 10.8% 8.8%

EBIT

91.7 9.4% 75.1 8.5%

BG Asia

Net sales

180.9 100.0% 145.3 100.0% 24.5% 20.6%

EBIT

25.0 13.8% 19.9 13.7%

BG SAMEA

5

Net sales

94.3 100.0% 123.9 100.0% –23.9% –5.7%

EBIT

–12.5 –13.3% 1.5 1.2%

Share AUTN

Share price at December 31 in CHF

202.40

169.50

19.4%

Market capitalization at December 31

938.1

783.0

19.8%

Basic earnings per share in CHF

9.12

17.03

–46.4%

Dividend per share in CHF

6

4.50

4.50

1

Change in local currencies.

2

EBITDA, EBIT, Net profit, RONA and Operating cash flow are disclosed before expenses in relation to the settlement with the German Federal Cartel Office

in the amount of CHF 31.5 million in 2015.

3

Net profit before interest expenses in relation to average equity plus interest bearing liabilities.

4

Full-time equivalents including temporary employees but excluding apprentices.

5

Including South America, Middle East and Africa.

6

As proposed by the Board of Directors and subject to the approval of the Annual General Meeting.

Financial highlights