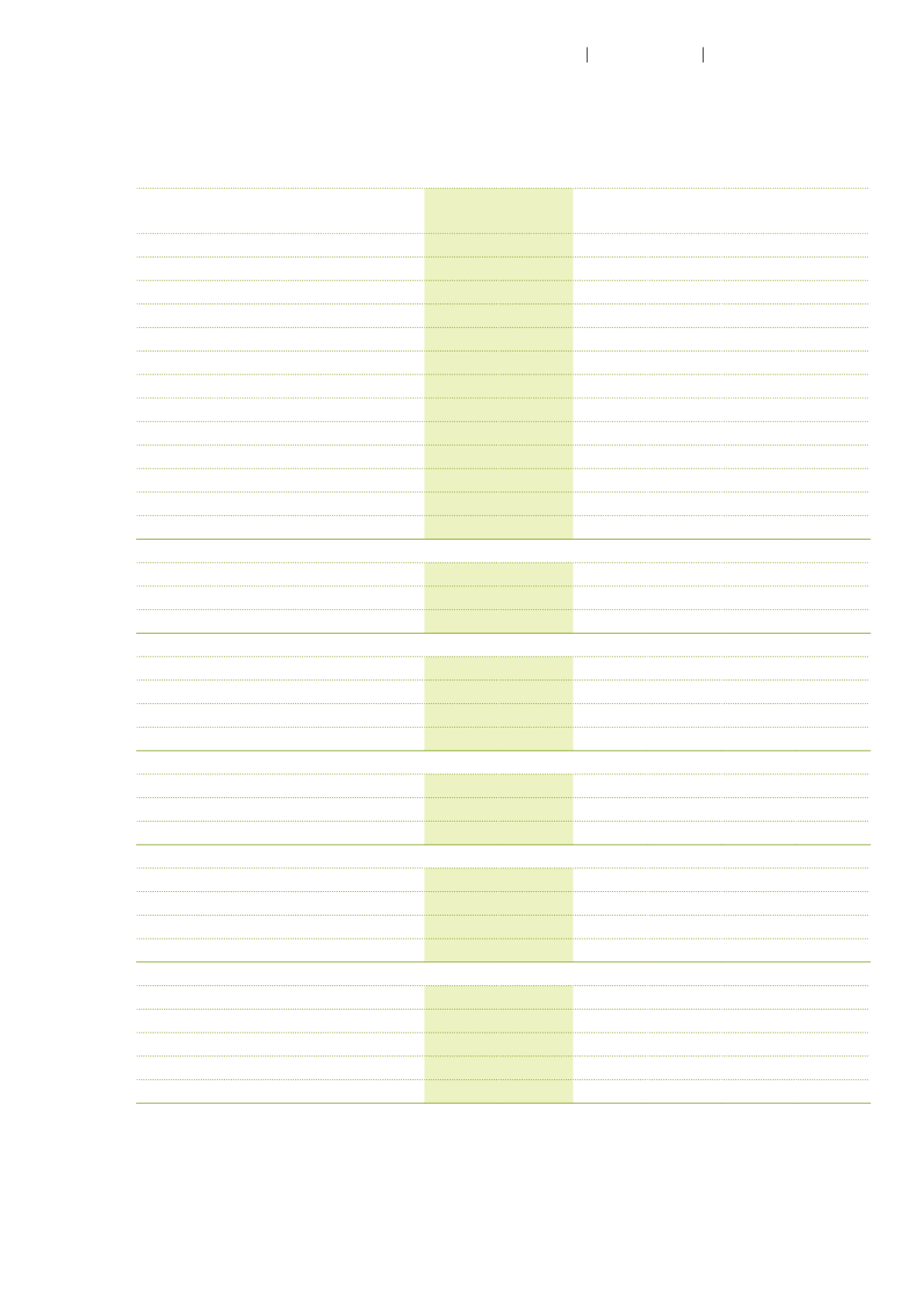

5

Autoneum Annual Report 2016

Letter to Shareholders

CHF million

2016

2015

Change

Organic

growth

1

Autoneum Group

Net sales

2 152.6 100.0% 2 085.9 100.0% 3.2% 6.8%

EBITDA

278.1 12.9% 191.5 9.2% 45.2%

EBITDA adjusted

2,3

245.0 11.4% 223.0 10.7% 9.8%

EBIT

204.5 9.5% 126.5 6.1% 61.7%

EBIT adjusted

2,3,4

175.6 8.2% 158.0 7.6% 11.2%

Net profit

133.8 6.2% 68.7 3.3% 94.8%

Net profit adjusted

2,3,4

117.0 5.4% 100.2 4.8% 16.8%

Return on net assets (RONA)

5

21.5%

12.7%

Return on net assets (RONA) adjusted

2,3,4,5

19.6%

17.7%

Cash flows from operating activities

194.1

111.7

Net debt at December 31

57.4

106.1

Number of employees at December 31

6

11 725

11 423

2.6%

BG Europe

Net sales

833.4 100.0% 833.2 100.0%

–

0.8%

EBIT

58.7 7.0% 44.7 5.4%

BG North America

Net sales

1 018.7 100.0% 977.9 100.0% 4.2% 9.0%

EBIT

119.1 11.7% 91.7 9.4%

EBIT adjusted

2

85.9 8.4% 91.7 9.4%

BG Asia

Net sales

210.7 100.0% 180.9 100.0% 16.5% 20.2%

EBIT

27.7 13.1% 25.0 13.8%

BG SAMEA

7

Net sales

93.5 100.0% 94.3 100.0% –0.9% 17.1%

EBIT

–13.4 –14.3% –12.5 –13.3%

EBIT adjusted

4

–9.1 –9.8% –12.5 –13.3%

Share AUTN

Share price at December 31 in CHF

267.25

202.40

32.0%

Market capitalization at December 31

1 243.4

938.1

32.5%

Basic earnings per share in CHF

20.61

9.12

126.0%

Dividend per share in CHF

8

6.50

4.50

44.4%

1

Change in local currencies, adjusted for the disposal of the UGN business in Chicago Heights (Illinois), USA.

2

Before gain from disposal of the UGN business in Chicago Heights in the amount of CHF 33.2 million (CHF 21.1 million after income taxes) in 2016.

3

Before expenses relating to the settlement with the German Federal Cartel Office in the amount of CHF 31.5 million in 2015.

4

Before impairment loss due to the intended adaptation of the South American production capacity in the amount of CHF 4.3 million in 2016.

5

Net profit before interest expenses in relation to average equity plus interest-bearing liabilities.

6

Full-time equivalents including temporary employees (excluding apprentices).

7

Including South America, Middle East and Africa.

8

As proposed by the Board of Directors and subject to the approval of the Annual General Meeting.

Financial highlights